Customs Union: New Edition of the Common Customs Tariff*

An updated Common Customs Tariff (CCT) of the member-states of the Customs Union taking into account Russia's obligations to the World Trade Organization came into force on August 23. Meanwhile, 90% of import duties remain at the same level.

An updated Common Customs Tariff (CCT) of the member-states of the Customs Union taking into account Russia's obligations to the World Trade Organization came into force on August 23. Meanwhile, 90% of import duties remain at the same level.

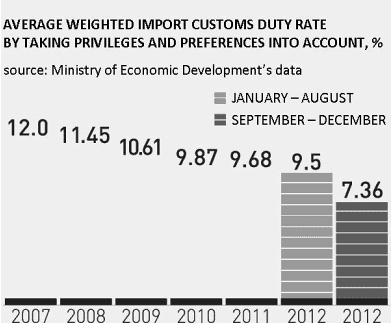

The new edition of CCT was approved by the Council of the Eurasian Economic Commission (EEC) in July. The reduction of import customs tariff will affect the rates for about 1 thousand commodity items of about 11 thousand. According to the preliminary estimates, with this new edition of the Common Customs Tariff, the average weighted rate of import customs duty will go down from 9.6% to 7.5-7.8%.

First of all, this means that import customs duties increased during the crisis period of 2008 – 2009 will be reduced to the initial level. The duties for another quarter of imported goods will be reduced to the level which the negotiators have agreed on three years after. The longest period for stipulated final rates to come into force is set at eight years for poultry meat, and seven years for cars, helicopters, and civil airplanes.

As Minister for Trade of the Eurasian Economic Commission Andrei Slepnev has earlier reported, tariff rates for some 25% of the total number of commodity items may be increased to the level of tariff obligations (the binding level), which gives additional opportunities to level negative effects of Russia's accession to the WTO on individual industries and producers.

As Minister for Trade of the Eurasian Economic Commission Andrei Slepnev has earlier reported, tariff rates for some 25% of the total number of commodity items may be increased to the level of tariff obligations (the binding level), which gives additional opportunities to level negative effects of Russia's accession to the WTO on individual industries and producers.

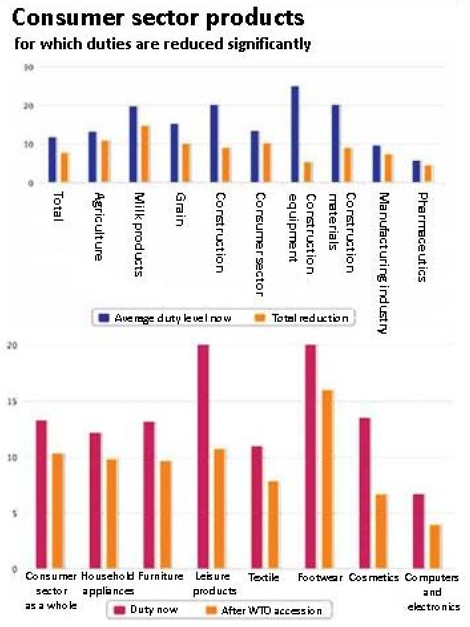

The most significant changes in tariffs have occurred for food products and other consumer goods. As for foodstuffs the changes will most affect meat and milk products as well as some kinds of vegetable and fruit.

So the duty for pork imported within the quota will be reduced to 0% from the previous 15%, but not less than 0.25 Euro per kilogram; for pork imported outside the quota – to 65% from the previous 75%, but not less than 1.5 Euros per kilogram. The import duty on ready-to-eat meat products will be reduced to 20%, but not less than 0.4 Euro per kilogram from 25%, but not less than 0.4 Euro per kilogram.

It is supposed that the quota for imported pork will be reduced on January 1, 2020, and the quotas for beef and poultry will be valid unless Russia cancels them. In particular, the quota for chilled beef in accordance with the WTO documents is 40 thousand tons for an indefinite period of time.

A new import duty for butter will be 15% on August 23, but not less than 0.29 Euro per kilogram against the previous 15%, but not less than 0.4 Euro. The import duty for most sorts of cheese will be changed. In particular, the import duty for green cheeses containing not more than 40% of fat will be reduced to 15%, but not less than 0.25 Euro per kilogram. And, for instance, the import duty for such cheeses as Camembert and Brie will be reduced to 15%, but not less than 0.3 Euro per kilogram from the previous 15%, but not less than 0.6 Euro per kilogram.

As for the fruit segment the import duty will be reduced for apple, lemon, and lime. As for the vegetable segment the import duty will be reduced for tomato and cucumber. For instance, the import duty for cucumber will be reduced to 15%, but not less than 0.08 Euro per kilogram – such a rate will be valid for the entire year. During the period from May 16 to October 31 the duty was 15%, but not less than 0.12 Euro per kilogram; and only from November 1 to May 15 the duty was reduced to 15%, but not less than 0.08 Euro per kilogram.

According to the obligations to the WTO, Russia will keep the prohibitive import duty for spirit unchanged, but will reduce the import duty for most alcoholic beverages from 2 Euros per liter to 1.5 Euros per liter during three years. The duty for mineral water, beer, wine, champagne, and vermouth will also be reduced significantly. The duties for ready-to-eat fish products will be reduced in prospect and only slightly – from 15% to 12.5 – 12% during one - three years. As for fish raw materials the duties for most kinds of fish raw materials will be reduced from the previous 10% to 6 – 8%, in particular cases to 3 – 5%.

In accordance with the WTO agreement there is a gradual reduction of duties for most part of textile products, including garments. For instance, on Thursday the import duty for coats, rainwear, jackets, and similar products will be reduced to 10%, but not less than 3 Euros per kilogram from 10%, but not less than 5 Euros; for suits, including those made of woolen fabric, trousers, dresses – to 10%, but not less than 2.5 Euros per kilogram from 10%, but not less than 4 Euros. The import duties will be imposed on shirts and blouses to the extent of 10%, but not less than 2 Euros per kilogram instead of 10%, but not less than 3 Euros. The duty for children's clothes remains at the level of 10%, but the plank will be reduced to 1.5 Euros from 2 Euros per kilogram. It is supposed that by 2014 the duties for most types of natural fur will be reduced from 10% to 5%; and for most pieces of fur clothing – by 2015 – from 20% to 10%. However, they still remain unchanged on August 23.

According to Russia's obligations, from the date of Russia's accession to the WTO the duties for household appliances and electronics remain unchanged, however, the duties for some goods items will be gradually reduced in the near future, beginning with 2013. So on January 1, 2013 the duty for cell phones will be reduced to 0% from the previous 5%. The duties for computers (both stationary and laptops) will be reduced from 10% to 9% by 2015. The duties for DVD-players will be reduced from 15% to 8% by 2016, for LCD- monitors – from 20% to 0% by 2015, for microwave ovens – from 20% to 10% by 2017, for vacuum cleaners – from 15% to 9% by 2015. Telecommunication operators do not expect significant changes in prices for equipment as the customs duties are only 5 – 10% now and will be gradually canceled by 2013 – 2015. The customs duties for some types of equipment are zero now.

By 2014 – 2015 there will be a reduction of duties for pharmaceutical products. However, it is on August 23 that there will be an insignificant reduction of duties for some items. The duties for perfumery products, cosmetics, and personal care products will be gradually reduced during some years as well. For instance, the duty for shampoo, toothpaste, lotions, perfumes, and toilet water will be reduced from 15% to 6.5% by 2016, in a similar way the duties for decorative cosmetics will be reduced, but only by 2017.

Russia's accession to the WTO affected the Russian machine-building industry slightly. The customs import duties for railway vehicles, vessels, and aircrafts remain unchanged.

In particular, the duty of 20% is imposed on civil airplanes having a passenger capacity of more than 50 seats, and civil airplanes having a passenger capacity of more than 300 seats are duty-free. Given that the duty rate for cargo vessels remains at the level of 5%, for yachts weighing more than 100 kilograms – 20%, for tugs – 5%, for refrigerated cargo vessels – 5%.

Meanwhile, the changes do not affect railway rolling stock as well. The duty rate for railway locomotives and Diesel electric locomotives will remain at the level of 10%, the duty rate for tank wagons and covered wagons will be 10% as well.

The most significant changes in the customs regulations affected the car industry. After Russia's accession to the WTO the duties for new cars will be reduced to 25% from 30%, and this duty rate will be valid during three years from the date of Russia's accession. Beginning from the fourth year to the seventh year the duty rate will be reduced from 25% to 15% in equal amounts or so. Meanwhile, the prohibitive dut ies remain valid for used cars older than seven years, and the duties for cars aged between three years old and seven years old will be reduced to 20%, including seven year old cars. The duties for tractors and trucks reduced partially, on an average to 15% from 20 – 25% for certain types of given transport vehicles.

To compensate for the losses of foreign car makers which launched production in Russia, Russia's authorities will put the utilization tax into force on September 1, 2012. The given taxes are supposed to be collected while new cars as well as used cars are being imported. The utilization tax will be imposed on car makers and importers, i.e. it will be included in the price of a car; and together with new reduced import duties it will be identical to the previous level of the import duties.

The customs tariff on imports of ferrous metal products remains unchanged – 5 – 20% for different types of nomenclature. As for the market of chemical products, in most cases, Russia's accession to the WTO will not bring significant effects; on the whole the duty rate will be reduced from 10% to 5 – 6.5%.

According to market participants, as a result of a gradual reduction of import duties, the competition in the sphere of low-tonnage chemicals will probably strengthen in the Russian market of chemical products, first of all, from the PRC car makers.

The reduction of trade barriers after Russia's accession to the WTO will reduce the cost of living thanks to a cheapening of both imported goods and domestic goods. As a result, prices could fall not only for finished imported goods and services but also for domestic goods, particularly those produced with imported components, the Ministry of Economic Development reckons.

The reduction of trade barriers after Russia's accession to the WTO will reduce the cost of living thanks to a cheapening of both imported goods and domestic goods. As a result, prices could fall not only for finished imported goods and services but also for domestic goods, particularly those produced with imported components, the Ministry of Economic Development reckons.

As a result of the tariff liberalization thanks to a fall in prices and the inflow of higher-quality goods, according to the Ministry of Economic Development, the consumers of such goods as fish, fruit, vegetables, nuts produced in tropical countries, confectionery products (chocolate), flowers, high quality wine and alcoholic beverages, rice, medicine, textiles, clothing, footwear, construction materials, jewelry, furniture, electronics and electrical equipment, medical devices and equipment, cosmetics, perfume, detergents, and automobiles will benefit.

Maxim Medvedkov, the head of the Russian delegation during the WTO negotiations, Director of Trade Negotiations Department of the Ministry of Economic Development of the Russian Federation has earlier said that prices for goods may begin to fall in 3-5 years, but inflation may quite compensate for this fall. The source: PRAIM.

* Originally published in "Investments. Facts and comments." Issue 3 (22)