Russia’s Investment Partners: Countries of Central and Eastern Europe*

The countries of Central and Eastern Europe are geographically close neighbors and important trading partners of Russia. The region's ten countries which traditionally account for about 95% of the Russian trade with countries of Central and Eastern Europe (CEE) joined the European Union (EU) in the current de cade; the aim to achieve such membership is a priority of the foreign economic policy of the other trading partners from CEE – the countries of former Yugoslavia and Albania.

The countries of Central and Eastern Europe are geographically close neighbors and important trading partners of Russia. The region's ten countries which traditionally account for about 95% of the Russian trade with countries of Central and Eastern Europe (CEE) joined the European Union (EU) in the current de cade; the aim to achieve such membership is a priority of the foreign economic policy of the other trading partners from CEE – the countries of former Yugoslavia and Albania.

A number of fundamental trade contracts and agreements (regarding the issues falling within competence of the EU) which CEE countries had with the Russian Federation were denounce d and changed by the Partnership and Cooperation Agreement (PCA) between Russia and the EU. At the same time the joint statement on EU enlargement and Russia – EU relations was signed. That statement comprises measures aiming to take into account the Russian Federation's interests and to soften some negative consequences of the enlargement of the European Union “to the East”.

New intergovernmental agreements enlarging and updat ing the contractual – legal base for cooperation between the Russian Federation and Central and Eastern Europe (including economic, industrial, scientific-technical cooperation, tourism development, air routes, etc.) have been signed as well as new bilateral intergovernmental committees on economic cooperation have been established over the past few years.

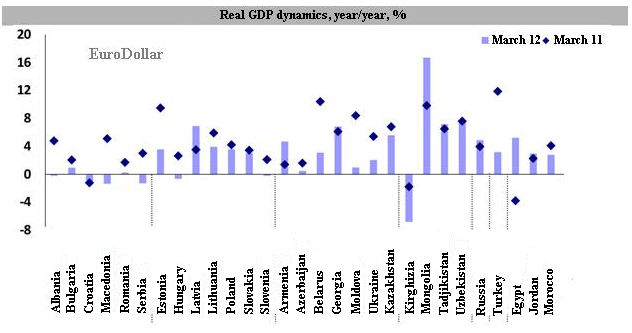

The experience of the past years has shown that on the whole the adoption of the EU trade regime has had no negative impact on the volumes of foreign trade turnover between Russia and the region of Central and Eastern Europe. In terms of a significant rise in contractual prices for energy sources (the average annual price for oil delivered to far-abroad countries has increased by 3.9 times, for gas – by 4 times) dominating in Russian exports, the results of the development of Russia's foreign economic activity with CEE countries are record in the current decade. In 2011 the mutual trade (at current prices) increased by 4.5 times as compared to 2000 and reached US$92.2 billion, which amounted to 12.5% of Russia's foreign trade turnover (14.8% of exports and 8.6% of imports). Russian exports, as before, traditionally exceeded imports and were equal to 3/4 of the monetary sales volume.

If the build-up of exports from Russia to CEE countries was caused mainly by the increase in world prices for commodities and semi-finished products, an unprecedented increase in imports which rose 9.5 times in 2001 – 2011 is determined by the expansion in physical volumes of deliveries of manufactured finished goods. Russia's sustainable economic development, CEE countries' competitiveness growth on the basis of getting financial resources from the EU structural funds, the growth of foreign capital invested in the region, and the expansion of the government support stimulated an increase in Russian imports from the region, first of all, machine tools. Vigorous capital inflows from the EU countries provided the development of a number of modern enterprises on the basis of Western standards, which promoted the expansion and renewal of the export basis of most CEE countries.

Despite an increase in import value, imbalance in goods turnover typical to foreign economic relations between Russia and CEE countries still remains. The countries of the region, as before, could not completely cover deliveries of Russian energy resources extremely necessary for them by national goods, and the trade surplus increased to US$46 billion, i.e. almost threefold compared to 2000. Although the trade imbalance index is up to 50% (76% in 2000), but, according to world measures, it still remains at a high level.

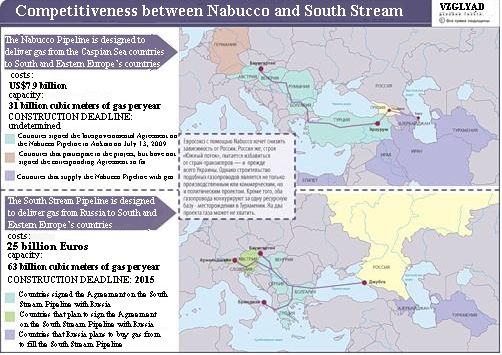

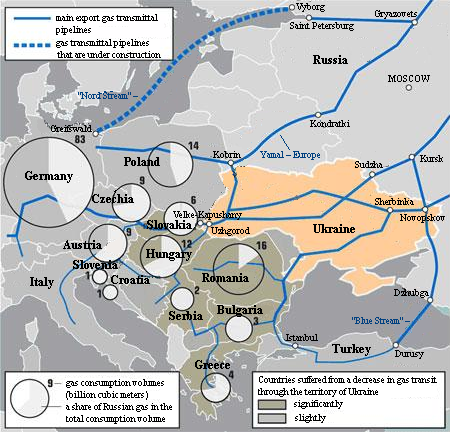

The countries of Central and Eastern Europe, despite the steps taken to diversify imports and to create alternative infrastructure, continued to buy large volumes of Russian oil and gas which come cheaper due to deliveries through pipelines (a less expensive mode of transportation compared to other types of deliveries) and account ing for fuel transit costs to cross their territory to Western and South Europe. In 2011 the oil deliveries to CEE countries rose to 55.9 million tons (42.7 million tons in 2000). The volume of natural gas exports, although it rose, but it rose slightly to 42.9 billion cubic meters (42.3 billion cubic meters in 2000), which is determined mostly by the expansion of its purchases by Hungary in other countries through the European main gas pipeline system which BP connected to by means of the pipeline “Gyor ( Hungary) – Baumgarten (Austria) in 1996.

Despite tense political relations as well as the import embargo entered into force in October 2005 on the whole number of food products, Poland remains a major trading partner of our country in the CCE region with sales volume s of US$27.2 billion (the 10th place in Russia's trade). Poland is followed far behind by the countries carried out reasonable pragmatic policies towards Russia (billion US dollars): Hungary (12.8), the Czech Republic (10.9), Slovakia (9.4). The trade with Albania and the countries of former Yugoslavia, particularly with Bosnia and Herzegovina, Macedonia, Montenegro is weakly developed: instability and political conflicts in the Balkans, a weak export potential, tough competition in the Russian market had a negative impact on sales volumes.

The nomenclature of Russian exports to CEE countries is limited. In 2011 more than 79% of the Russian exports accrued to energy resources compared to 74% in 2000. Fuel export congestion increased over the last five years is one of the key problems of trade-economic relations between Russia and CEE countries. CEE countries' sustainable economic development (in 2010 the GDP growth rates of the new ten EU member states was 40% compared to 2000), price competitiveness, refineries acquired by Russian companies in the region stimulated an increase in demand for oil and gas.

Russia's loss of trade niches of manufactured finished goods in the CEE market led to a fall both in exports (more than by US$460 million) and in the share of engineering product s – up to 2.2% of Russian exports (8.4% in 2000). The reason is a low technological and innovation potential of the national industry as well as inconsistency between output product s and technical and economic regulations and standards of the European Union.

We also remark that CEE countries' accession to NATO materially limited Russian deliveries of weapons and military equipment, even in payment for the Soviet debts. First of all, basic goods in Russian exports of engineering product s to CEE countries are heat -causing elements (HCE), as well as cars and trucks, repair parts and components to them, railway rolling stock and its repair parts. Thanks to a good conjuncture for commodities and slightly processed products which are the basis of Russian exports, there was an increase in exports of the other commodity group s (except light industry products), first of all, in the position “Metal and metal products”.

Significant changes connected with an increase (of 16 percentage points) in the share of the traditionally leading group “Machinery, equipment, and transport vehicles ” - almost up to 45% (29% in 2000) took place in Russian imports. The improvements in Russian imports are mainly determined by activities of transnational corporation s, enterprises with foreign capital participation which launched production on the territory of CEE countries, the production being oriented to sales of goods in the capacious Eastern markets. As a result of an increase in purchases, imports of engineering products (US$6.9 billion) from CEE countries exceeded exports of similar Russian goods by 6.7 times. Relatively large commodity group s of Russian imports are also chemical product s, foodstuffs, cellulose and paper products, metal products. Financial resources received by new EU member states to develop the agricultural sector as well as subsidies received from the EU budget to deliver agricultural products to the markets of third countries were an important reason for increasing imports from CEE countries.

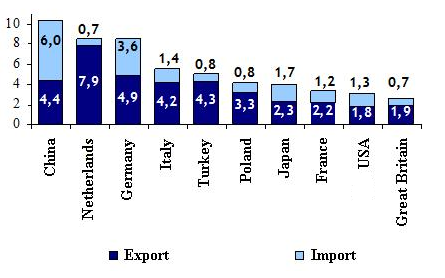

Major trading partners of the Russian Federation (outside FSU), 2011, billion dollars

Although imports still remains implicit ly customer - oriented (cars, household appliances and electronics, pharmaceuticals, perfumes and cosmetics, and other), deliveries of investment equipment and rolled metal products have increased over the last years, which, along with the modernization process of the Russian economy, is determined by a number of manufacturing enterprises acquired by Russian companies in the region.

According to the Partnership and Cooperation Agreement between Russia and the EU, mutual trade between Russia and new EU member states is carried out on a most - favored - nation basis; a very small part of Russian exports i s under the Generalized System of Preferences (GSP) granted by the European Union to our country in 1993. After accession to the EU, the average level of duties for Russian manufactured goods imported to new EU member states decreased from an average of 9% to 3.8%, which created favorable conditions for an increase in exports of the whole number of products of the manufacturing industry. At the same time higher duties which were absent earlier began to be applied to a number of export positions (for instance, to aluminum and its alloys). Duties are not imposed on fuel and raw material goods dominating in the structure of Russian exports in the region. High tariff rates are applied to imports of agricultural goods, particularly, dairy products, and processed vegetables and fruits.

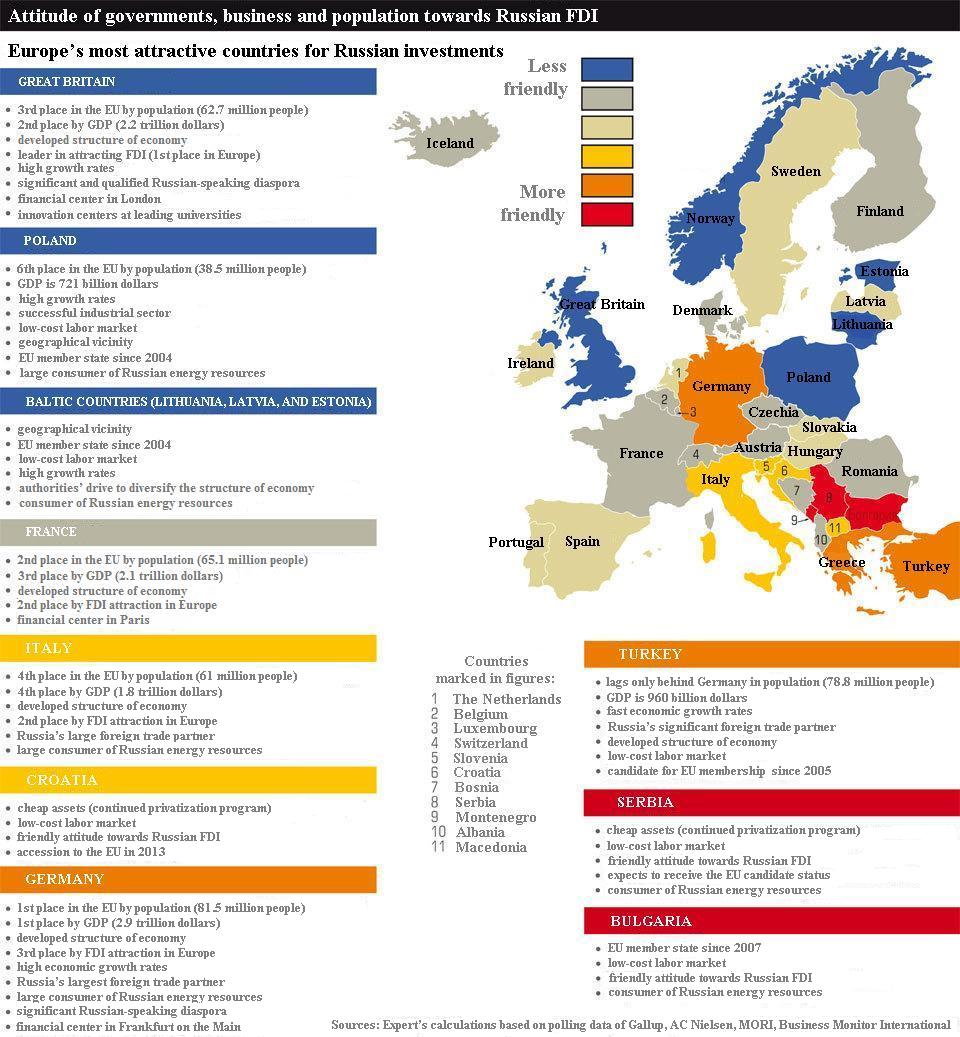

The application of EU anti-dumping measure s as well as quantitative restrictions in relation to a number of iron and steel products (the latter will probably remain until Russia's accession to the WTO) makes the work of Russian exporters in the market of CEE countries more difficult. Investment activities of large entrepreneurial structures have a certain impact on the dynamics and structure of mutual deliveries of goods between Russia and CEE countries. In the current decade the motive s which were important for Russian companies to invest in the region were as follows: the opportunity to solidify in a number of economic sectors of countries joining the European Union, to avoid tariff and non-tariff barriers, and to realize goods on the territory of the enlarged European Union without restrictions.

Native businesses invested capital in the Balkan countries' economies especially actively, which was stimulated by low prices of enterprises set out for sale, low competition as well as by the aim to build vertically integrated companies, and by that to take control of the whole processor chain, including refineries and oil-product distribution channels.

The first Russian companies which acquired foreign assets in the region were Gazprom and LUKOIL. Investments made by Russian raw materials companies allowed partially taking control of distribution channels and transfer streams of domestic energy resources, keeping raw materials ties between the region and Russia.

Unsatisfied demand in Russia as well as anti-dumping measure s and import quotas for Russian rolled steel applied by the European Union were reasons for acquiring the whole number of iron and steel enterprise s in CEE countries. Acquiring one of the leading producers of rolled steel “Vitkovice Steel” by Evraz Group S.A. and the CEE largest producer of pipeline industrial armature JSC “MSA Group” by JSC “Chelyabinsk Tube-Rolling Plant” in Czech Republic are among key deals made over the last years. The iron and steel company “Mechel” ( Lithuania and Romania), “Iron and Steel Tube Company” (Romania), as well as the “RusAl” (Romania, Montenegro) and the aluminum company “Marko Investments and Industries” (Romania) have assets in CEE.

Unsatisfied demand in Russia as well as anti-dumping measure s and import quotas for Russian rolled steel applied by the European Union were reasons for acquiring the whole number of iron and steel enterprise s in CEE countries. Acquiring one of the leading producers of rolled steel “Vitkovice Steel” by Evraz Group S.A. and the CEE largest producer of pipeline industrial armature JSC “MSA Group” by JSC “Chelyabinsk Tube-Rolling Plant” in Czech Republic are among key deals made over the last years. The iron and steel company “Mechel” ( Lithuania and Romania), “Iron and Steel Tube Company” (Romania), as well as the “RusAl” (Romania, Montenegro) and the aluminum company “Marko Investments and Industries” (Romania) have assets in CEE.

Russia keeps significant economic interests in the geographically close region the countries of which traditionally are distribution areas for fuel commodities and important transit territories. Around 28% of exported natural gas, 21% of oil, 11% of coal, 15% of electricity were sold in CEE. Up to 40% of the volume of export deliveries of Russian gas and up to 30% of oil are transported through the territory of a number of Central-European countries (Poland, Hungary, Czech Republic and Slovakia) to Western and South Europe. As for the CEE position in relation to Russia, the realities of economic life and pragmatic consideration s determine their interests in developing cooperation with our country. The exploitation of oil and gas pipelines brings countries real incomes as transit charges.

The immense Russian market of goods and services allows building up exports of goods of the manufacturing industry, which is important due to distribution problems in western countries. Russia is the main supplier of energy resources to most countries in the region. Basic needs of the region's countries in energy resources are satisfied by imports from the Russian Federation. According to the European Statistics Bureau (EuroStat), Russia fully satisfied import gas needs (at value) of Czech Republic, Latvia, Lithuania and Slovakia – by 99%, Romania – by 91%, Hungary – by 75%, Slovenia – by 49%; import oil needs – the main part of import demand, including Slovakia, Poland – by 95%, Lithuania – by 96%, Hungary – by 95%, Czech Republic – by 62%, Estonia – by 55%, Romania – by 54%.

Good political relations with the Russian Federation are considered by most countries in the region as a necessary condition for provision of reliable supplies of energy resources. In the current decade outright thanks to a good conjuncture in the energy resource market, Russia's presence in the CEE market decreased slightly.

Thus, due to the expansion of economic relations between Russia and CEE countries as well as the development of international cooperation infrastructure, the significance of economic cooperation with the countries of South-Eastern Europe (SEE) occupying an important place in plans for ramping up Russian oil and gas exports to Europe is increasing.

* Originally published in “Investments. Facts and comments.” Issue 26.