Crisis Anatomy – Part V. European Economic and Financial Crisis: Risk management

In the fifth part of the “anatomy series”, risk management (RM) issues are discussed. RM covers several themes on the general and sectoral level. Present crisis has shown that RM was not taken seriously enough in either the financial sector or in general economic strategies; the least in national development models. Strange enough, there is no evidence that RM is already being treated as one of the important aspect of organizations and/or undertakings' activity. RM is in “decision vacuum”, as risk advice comes generally from regulatory authority; therefore unbiased RM is needed – global, European and national.

At a time of present financial and economic crisis both lay people and authorities are asking the same question: how did it happen that the coming threats could not be predicted or at least foreseen. The RM's issue, in fact, was addressed from a financial standpoint already on the eve of the crisis, in May 2007 (1). A couple of interesting conclusions have been made at that time:

-

first, modern economic development created a new set of risks (more complicated and system-like risks), and

-

second, an optimal market based RM shall be installed for a market-based valuation of bank's credit portfolio and “public” assessment of national development models.

Experts on financial issues argued that modern crisis has a systematic character, the fact that made it extremely difficult to predict and properly assess, hence the present outcomes. However, some analysis can make the future risk assessment a more foreseeable and predictable task. The successful approach would challenge conventional thinking.

Main RM concept and alternatives. Risk management (RM) is generally understood to mean “a process for alerting senior executives to unexpected problems, as well as clear procedures for identifying and managing all sorts of foreseeable risk (bold mine, EE)” (2).

Three aspects of modern RM concept are important in the mentioned definition, if transferred into functions; these aspects are generally common to other publications on management and marketing:

-

First RM's function is to warn or alert senior executives on possible risks and unexpected problems facing the business or/and public entities;

-

Second RM's function is to identify foreseeable risks; and

-

Third RM's function is to manage all sorts of such risks, foreseeable of course, in the first place.

As to the first “conceptual function”, RM quite seldom makes any sensible alerts of expected “situational character”. Even when it does, these alerts are not dealt with accordingly, as happened with the present crisis: the alerts for financial sector have been in the agenda already for more than two years ago without managerial outcomes (3).

As to other two functions, the process of crisis identification and management becomes a function of political, economic and legal prerequisites, which is too difficult to alter presently.

Financial crisis: first alert. We can acknowledge that there is much more focus on RM presently than two or three years ago. The crisis has shown that we are facing rather new type of risks. For example, liquidity risk as a major problem for asset management that had not been in the risk models before. Besides, increasing use of complex financial instruments requires more sophisticated RM; and global banking system exposed various countries to new operational and systematic risk. This complicated sphere is clearly seen in the Google website: there are more than 36,5 mln (!) hits on “risk management” (data from March 2011).

Financial sector is more active presently to clarify the fact that managers failed to control risk hazards. Thus, Peter de Proft, director general of the European Fund and Asset Management Association argued that the asset industry “had outstripped its own ability to manage risk”, being largely shortsighted. Naturally, all kind of investors are focused on RM.

Various surveys conducted recently have shown that poor strategic understanding for large financial loses are generally blamed during last two years; RM was not treated as an important sector in the market organisations. More than that, RM status has often declined without plans for future changes (4).

In this article, Steen Thomsen, a professor at Copenhagen Business School argued that RM was presently in a decision vacuum, due to the fact that the main source of risk advice came from public regulatory authorities, especially in asset management.

Keeping in mind that banking and financial sectors are quite separate from important public decisions, it would take a long time for regulators to respond, it seems. However, one step in a process of regulatory reform has been taken: Committee of European Securities Regulators recently released “consultation statement” on RM principles for Ucits, European retail fund structure. The next move would be to install the RM function into financial service industry.

Neelie Kroes, former EU Commissioner for competition (presently, Commission's vice-president and in charge of Digital Agenda) once said that “in recent years, the banking system and financial investors wanted too much, too quickly. Too much risk was taken with other people's money, with dramatic systemic consequences: more than €3,000bn of other people's money – that of taxpayers – has now been used to pull banks out of the hole they dug for themselves” (5).

Surveys in different countries and organisations have shown the RM's low priority despite the financial and economic crisis. The abovementioned “decision vacuum” in RM at present can be attributed to the fact that the main alerting body of risk advice comes from either national or/and international regulatory authorities.

Risk hazards: the European Union's role. Risk assessment has been an integral part of all the study programs in management courses. However, it did not prevent the financial sector from collapse. The main reason behind the problem was introduction of numerous financial instruments with all the complexities of their functioning. Investors could not figure out how these schemes were managed; and often the “operators” could not make it either.

Huge liquidity inflow into banking sector made it questionable for the EU competition rules to deal with such state aid on a massive scale. Thus, in recent years the banking system and financial investors worked hard striving for quick profits.

The EU Commissioner for competition met almost every European big bank chief executive since the financial crisis began. Quite remarkable fact, she argued, that most of them were in denial, considering that “their” bank had no problem – only others did. Such “denials” – not just from bankers' side – suggest we need only focus on stability, setting competition rules aside. European banks cannot set aside the Union rules, said Neelie Kroes, pointing out this was the “ muddled thinking”. Instead, stability should have come first in order to safeguard citizens' savings and proper financing the economy. Without taking into account control hazards, present stability has come at a very high price. No doubt therefore that the crisis has hit hard mostly the banking sector and construction industry in Europe (in the UK, as an example) and management/financial sector (e.g. in the US).

The Commission has come with the suggestion in April 2009 for the member states when approving national aid to rescue banks and maintain lending to the real economy. The European Commission imposed conditions to ensure co-ordination between member states, to enforce the European Union's single-market rules and to preserve free competition among banks, both now and after the recovery.

European and American responses. It is clearly seen that continental Europe was less exposed to financial crisis: it has been less dependent on mortgage-based securities. That gave the banks a vision that they could ride out of the crisis. Too many leaders in the EU thought that they did not need a Europe-wide solution to the crisis. However, the amounts involved in various rescue packages are enormous: IMF expects write-downs by banks in the eurozone only to reach $750 bln in the next two years, plus $200 bln in the UK alone (6).

Europe's delayed involvement is explained by the fact that most of its financial intermediation is still done by banks, not by a shadow banking system. Securitised lending is a small part of total credit. But since recession hit the real economy, European banks suffered great losses and IMF's conventional loans were expected to cover most of these losses.

Accounting rules also allow banks to avoid writing down losses on loans until they materialise. But that does not remove their incentive to de-leverage, if they expect those losses to come eventually. Policymakers are therefore right to worry that credit is being withheld from the wider economy. To prevent a credit contraction in a recession, banks must be forced to hold enough capital to sustain lending.

Hence, the need for capital adequacy audits or “stress tests”, argued the Commission. In Europe's integrated banking market, such tests – and the consequences for banks that fail them – should be designed in common and applied consistently in different countries. A patchwork of national solutions inevitably distorts competition and ignores their negative effect on neighboring countries.

Neelie Kroes, former EU competition commissioner, tried to enforce a level playing field; but subjecting national policies to state aid rules was not a substitute for a common policy. There will be political obstacles to a common approach in the EU as long as member states retain final responsibility for recapitalising insolvent banks. That does not alter the hard fact that only a common approach among all EU member states will work.

Private equity response to systematic risk. Simon Walker, chief executive of the British Private Equity and Venture Capital Association warned that proposed EU directive on alternative investment fund managers published by the European Commission in April 2009 was absurd. “What is being suggested would bring a huge number of mid-market private equity houses into a new and onerous regulatory regime and in so doing would also capture many hundreds of portfolio companies”, - writes S. Walker (7).

The justification for intervention is the “systemic risk” for which alternative investment fund managers are allegedly responsible. Some have indeed been accused of playing that role, such as the hedge funds. But private equity has not been charged with adding to system risks, either in this proposal or a series of other international reports. There is no rationale for the Commission to intervene against private equity. Yet, if the EU investment directive were to become law, it would have a dramatic and damaging impact on the industry.

There is a deep irony in this: private equity is well positioned to assist Europe's economic recovery. It has more than €114bln ($150bln) in funds in Europe ready to deploy in acquisitions. It has already played an important role in rescuing ailing and failing companies in Britain, as well as in Germany and Sweden. It is a force for good which European political institutions should be encouraging rather than threatening with intense regulation, - argued S. Walker.

There are a number of detailed provisions which will adversely affect the larger buy-out houses. The most striking feature of the EU proposal, nonetheless, is the effect it would have on the mid-market sector and pure venture capital companies which expand beyond a certain size. The direct UK additional expenditure would be in a range of ?25,000-?30,000 per company in the portfolio, with the sizable indirect additional costs. This measure would thus heap utterly unwarranted costs on parts of the economy, which should be left free to create real value and would do so at the worst possible time (8).

The scheme seems unfair to some experts arguing that it will have a severely anti-competitive bias. A huge range of privately controlled companies will be excluded by these regulations, while those owned by private equity will be compelled to obey them. It will also create a vast and unwanted burden for the regulators and the FSA would be obliged to police a swathe of companies far smaller than its normal customers, for which it lacks the in-house expertise and in the knowledge that there is nothing to be won in terms of enhanced economic stability.

The British interests often run across those on the continental countries: almost 60 per cent of the European private equity industry is located in the UK and about 40 per cent of European portfolio companies which are presently hit by the crisis are owned by private equity houses based in the UK. A “regular British response” is to resist the EU initiatives but such British government steps would be profoundly bad for British business. Some say that it is insane to imply that the financial crisis means thorough regulations for small and big - publicly quoted - companies. But this is precisely what will happen if ministers in sectoral economies would not find an adequate solution.

Global risk assessor. As a radical solution to the global and national RM issues policymakers are increasingly calling for the creation of an early warning system to prevent future financial, economic and other kind of crisis. It is, in fact, unclear as to who would operate such a system and how it could work. However, some economists have made some suggestions: thus former chief economist of the EBRD and World Bank Nicholas Stern's comment deserves a special attention. Mr. Stern suggested a “global risk assessor” to detect and manage crisis promptly, authoritatively and independently of “big countries and important economies” (9).

Unbiased assessment of global economic system's stability is based on two requirements - it must be independent of: a) existing international financial institutions (which is theoretically possible), and b) important economies (which is difficult to imagine).

The European crisis: the need for global macroeconomics. Already at the September 2009 G-20 summit in the US, the world's leaders obsessed with the economy's financial sector and banking regulations suddenly turned to the global political economy.

After more than two years in the crisis, the global leaders have been slowly moving to the official recognition that the crisis was not only about dealing with the financial regulation and supervision only; it has deeper roots in global macroeconomic policy.

Some argued that the main problems lie in the global economic-financial imbalances and stem from the following premises.

First, the evident lack of an appropriate “self-correction” mechanism for dealing with the global imbalances. The bi-polar world after the 2 nd WW managed to provide a “reasonable balance” for half a century Western democracies and the Soviet block. But then, during the last two decades, the US-only “guided adjustments” in current account surpluses and deficits have led to disastrous consequences. Hence, the need for macroeconomic policy agenda.

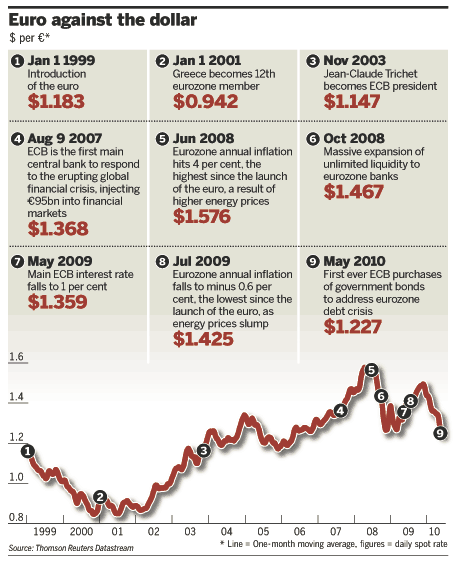

Second, the decade influence of the euro, as the “global reserve currency”, on the economic development in the now 17-eurozone members, e.g. in Germany, France and Italy. The eurozone has been running a small though a constant deficit in comparison to other EU members (and there are large cross-country imbalances inside eurozone). Stronger rules for stable common currency have been voiced lately, which could keep euro's role as a stable and balancing factor.

Third, the lack of macro-economic policy actions on a global level, does not serve the world stability either; besides, the national economies are becoming increasingly inter-connected. The problem to be resolved is that an optimal macroeconomic regulation policy shall be appropriate to the specific circumstances of most influential countries. So far, there are numerous inherent differences among the main sub-regions in the world, e.g. the US and the EU, BRIC and others.

Fourth, there is a certain dichotomy between the two approaches to “capitalism”: a pure western-type (the US example) and so-called European “social market economy”. Some argue in this regard about the inherent “public vs. private” options for solution: e.g., caps on current account imbalances are doubtful, as soon as their major consequences are driven by the private sector. Besides, private interests still generally govern economic growth with public involvement being often criticized and deemed to failure.

On the European level, these trends clashed during last decade at least twice while re-directing the Stability and Growth Pact of 1997. Recently, in the EU-2020 strategy (the Union's stability and growth pact for the next 10 years in 2000) the call for the member states to intensify public efforts has dominated (10).

These “backgrounds” of the global economic-financial imbalances are difficult to overcome in a stroke; they need coherent and timely efforts. However, it is important that the global G-20 meetings have become a sign of necessity, though they do not have any legitimacy to impose decisions on the member states. Nevertheless, their efforts and opinion will definitely count; besides, the members of the G-20 account for the lion's share of global imbalances. Hence, they must find optimal solutions, as well as draw efforts, to eliminate such crises in future.

Additional assistance through European Funds. Numerous EU Funds provide additional opportunity for increasing economic potentials and activating employment. One of these funds is the EU Globalization Adjustment Fund, EGF.

Since its creation at the end of 2006, the EU's Adjustment Fund assisted declining industries in several EU member states. Thus, during three years of its existence, the Commission distributed € 365 mln through 64 projects and assisted about 70 thousand workers. Most certain, Member States can use the opportunities provided by EGF to assist redundant workers. Lithuania has been most active in the EGF; however, all other countries can participate: the EU makes available € 500 mln per year for the EU-27. The revised rules are applied from the end of 2009.

EGF was created to support workers who lose their jobs as a result of changing global trade patterns so that they can find another job as quickly as possible. When a large enterprise shuts down or a factory is relocated to a country outside the EU, or a whole sector loses many jobs in a region, the EGF can help the redundant workers to find new jobs as quickly as possible. It forms part of Europe's response to the financial and economic crisis.

The economic recession means that companies (e.g. in the engineering sector) have been hit hard by the sudden drop in demand for mechanical and electronic machinery. It is often hard for the redundant workers both to find new opportunities and occasionally move to other sectors. The Commission makes some moves to support and training, which EGF can provide, to facilitate the transition to new jobs. As one of the examples, the European Commission approved two applications from Denmark (Brussels, 02 August 2010) for assistance from it. More than € 10 mln is provided to assist Danish government to return 1,149 redundant workers back into employment. The workers lost their jobs in the engineering sector after the economic slowdown exacerbated an already difficult situation for two Danish companies, i.e. Linak A/S and the Danfoss Group. The applications will now go to the European Parliament and the EU Council of Ministers for the final approval.

In total the two Danish applications relate to 1,641 redundancies, of which 1,443 were in three companies in the Danfoss Group and 198 in Linak A/S. The dismissals were a consequence of the rapid decline in demand for mechanical and electronic machinery and financial pressures that left some companies with no alternative but to let workers go and transfer production to places with lower costs.

All the companies affected are located in Sonderborg, a municipality in a relatively isolated part of Denmark where the iron and metal industry represents around 25% of all employment and where the engineering sector was the largest single sector. The impact of these redundancies at local level is huge and will push up the unemployment rate in an area where it is already higher than the national average.

It is expected that the EGF assistance may include training in tourism and energy technology, education and training in business management and remedial education; employment incentives (such as incentives for people who wish to change careers) and also several incentives for business start-ups.

Fund's last three years' account. There have been 64 applications to the EGF since the start of its operations in January 2007, for a total amount of about €365.3 million, helping more than 68,500 workers.

EGF applications related to the following sectors:

- automotive (France, Spain, Portugal, Austria, Germany, Sweden);

- textiles (Italy, Malta, Lithuania, Portugal, Spain and Belgium);

- mobile phones (Finland and Germany);

- domestic appliances (Italy);

- computers and electronic products (Ireland and Portugal);

- mechanical/electronic (Denmark);

- repair and maintenance of aircraft and spacecraft (Ireland);

- crystal glass (Ireland);

- ceramics and natural stone (Spain);

- construction (Netherlands, Ireland and Lithuania);

- carpentry and joinery (Spain);

- electrical equipment and furniture (Lithuania);

- publishing and printing industry (Netherlands and Germany),

- retail trade (Czech Republic and Spain) and wholesale trade (Netherlands) (11).

Final reports from the earlier cases supported by the EGF show strong results in helping workers stay in the labour market and find new jobs.

The EGF can fund active labour market measures focused entirely on helping the workers made redundant as a result of globalization, for example through:

- job-search assistance, occupational guidance, tailor-made training and re-training including IT skills and certification of acquired experience, outplacement assistance and entrepreneurship promotion or aid for self-employment,

- special time-limited measures, such as job-search allowances, mobility allowances or allowances to individuals participating in lifelong learning and training activities.

The EGF is not funding, so-called passive social protection measures, such as retirement pensions or unemployment benefits, which are the competence of the Member States. Only the workers made redundant because of globalization may benefit. The EGF does not finance company costs for modernization or structural adjustment. The EGF is connected to other EU funds. For example, the EU Structural Funds, in particular the European Social Fund (ESF), support the anticipation and management of change with activities, such as life-long learning, with a strategic and long-term perspective. The EGF, on the other hand, provides one-off, time-limited individual support geared to helping workers who have suffered redundancies as a result of globalization (12).

The risk management at the EU level is intervened into the so-called “annual EU work programs”, WPs. The European Commission adopted its first WP for 2010 on 31 March 2010. It reflects the Commission's determination to lead Europe out of the economic crisis and deliver policy that eliminates economic and financial risks to states, business and citizens. The Commission has agreed on a list of 34 strategic priorities to be implemented in 2010, with another 280 major proposals under consideration during later 2-3 years.

Each year the Commission formulates the work program for the EU-27 members concentrating on the most vital actions and activities. However, the WP-2010 program is specific, i.e. it is made according to the new tasks accredited to the Commission in the Lisbon Treaty (art. 17, TEU). That means that the EU member states agreed on designed priorities with an indicative list of initiatives for the years to come. The work program is an ambitious but realistic agenda showing the necessity to act – business as usual is not an option any more (13).

The risk assessment and management in financial sector is much more complicated and cumbersome. Governments and banks, seldom by companies, issue bonds; firms issue stocks/shares. Bonds and shares are issued with orientation for the potential investments with a view to profits; thus, bondholders and shareholders bear the investment risk. What kind of risks are there in financial markets? Buying risky assets is justified only by an additional reward: the risk of return is adjusted by a risk premium (higher return, higher risks). Financial market allows for an investor to find assets with a corresponding (affordable) risk level. Generally, markets balance demand and supply by setting risk premium (14).

However, financial markets do not just “price the risk”; they allow for diversification. The problem with financial markets during last decade was the increasing variety of “risky assets”, i.e. possibilities for profitable investments. Thus, numerous risky financial portfolio appeared with higher risk premium, though initial emission has never been funded in solid assets (as it happened with sub-prime house mortgage and loans). Risk diversified assets are difficult to trace when there are thousands and even millions of “stakeholders” in different continents. The latter phenomenon is called “asymmetric financial account” and could be difficult to tackle at the national level. In this situation some international regulations would help, e.g. Basel I, II and III for interbank markets and assets.

Perspective risk elimination

In the crisis almost-aftermath period, the EU states are facing numerous urgent and difficult problems to solve: making their economies progressive, finding better ways out of crisis, preventing future shocks and avoiding dangerous risks. Among several economic models existing in Europe, the EU has to find one or two most adequate to the European stability. At the same time, the member states have to agree on such models: a difficult task for some governments.

It has been generally acknowledged by the European politicians, economists and academia that the Europe's most acute risk problem presently is connected to banking sector caused by mismanaged financial institutions coped with that of the critical sovereign debts. This is what Europe is facing in the prevention risk situation in the so-called post-crisis period.

Probably, new guidelines for national economies would make certain push towards preventing future risks. However, for the member states the task of avoiding risks while making their “own economic policies” seems even more complicated as these policies shall be allied into a common “European economic model”. The idea is to avoid European risks through national efforts, the idea that nevertheless becoming very urgent at present, when the EU is trying to figure out the regions' greatest shortcomings and perspectives. Such “European model”, if at all be formulated, would fit into the EU-27 member states' economic and development priorities, which are so far extremely “individualistic”. However, the risks are both national and European!

In early February 2011, the EU member states were given a Franco-German proposal for a competitiveness pact with the main idea of creating more efficient economic governance at the “Union's level” for the member states. The important side effect was naturally to avoid inherent risks. Competitiveness idea seems to be generally accepted by all EU members, though the means and instruments to reach such “governance” widely divided.

It looks obvious that the main European problems are embedded first – in low and outdated productivity, and only secondly –in the lack of competitiveness. Some argue that the “single market” would resolve all problems. However, there is still room to work on the effective side of this market: dismantling barriers to trade, activating external export, creating common corporate tax base, etc. With this in mind, three prominent European politicians, i.e. former prime minister of Belgium (Guy Verhofstadt) and two former presidents of the European Commission (Jacques Delors and Romano Prodi) have come up with some proposals. No doubt, that these proposals would make their impetus into avoiding further risks in all EU-27 member states (15).

It has to be noted that Franco-German proposal was not greeted by all the member states. Even in Germany it aroused a storm of skepticism: at the end of February 2011, about 200 German economists wrote a letter to Financial Times denouncing the European Stability Mechanism (ESM) deemed as the permanent EU anti-crisis body from 2013. This is why the British financial daily suggested that “competitiveness agendas” was a waste of time that should be instead devoted to solving debt crisis (16).

Some experts argue that it is important for avoiding risks to elaborate a “clear and united path to convergence on an agreed set of policy measures”. That should be done after “a strengthened social dialogue” at the EU-27 level with trade unions and corporate/business organizations (17).

The Commission's main role is to lay down the foundations of a “new economic model” for Europe that would give the EU a competitive edge in global competition. That is not an easy task, as its performance needs a strong consensus among all 27 EU members.

Monitoring risks. Another urgent issue is a regular monitoring of existing and future risks (most probably by the Commission, with the necessary pressure tools and sanctions). The abovementioned three politicians, including two former Commission's presidents have recommended even a creation of a “cluster of commissioners” with economic governance and competitiveness' competences. It is clear that the member states are reluctant to sanction each other; instead the Commission would acquire the monitoring and controlling functions.

The idea of elaborating perspective reforms for the EU is in line with the Union's efforts to avoid risks. One part of it is to make an urgent and elaborated analysis of the present and perspective moves towards greater competitiveness. The ministries and academia, with the help of another professional organizations and civil society must get together for a fruitful dialogue on the issue.

That work could be a good impetus into the perspective elaboration of a due mechanism for avoiding risks in European future development.

Risk management in eurozone. European stability is generally based on risk-free development in the eurozone states. The EU's eurozone “security cushion”, otherwise known as European Financial Stability Facility (EFSF) equals € 420,6 bln. More than half of the “stability bond” is coming from three biggest eurozone states – Germany, France and Italy. They are becoming the main EU governments' guarantees concerning temporary fiscal union.

At the end of January 2011, the most important bond issue in 2011 is taking place performed by the new Financial Facility. The reason is that despite the known € 420,6 bln facility EFSF can only lend about € 255 bln; it has to be collateralized for rating purposes.

Government guarantees are quite unequally provided: three biggest states, Germany, France and Italy provide some € 290 bln, other five (Spain, Netherlands, Belgium, Austria and Portugal) make for about € 115 bln, other 9 eurozone states – €16,7bln . The eurozone states, one can say, are really different in their economies and power.

The EFSF, with headquarters in Luxembourg, has actually three options in issuing bonds and fund bailouts for eurozone states in crisis:

-

Sell bonds to outside investors, e.g. Japan (or may be even to China) or/and sovereign wealth funds;

-

Buy eurozone government bonds instead of ECB, or

-

Perform as a precursor to common eurozone bond issuance (18).

The bond issue will be managed by Citigroup, HSBC and Societe Generale ; the issue is expected to make € 3-5 bln of five-year bonds. The general opinion is that the issue will go well, in particular, after Japan pledged to buy more than 20 per cent of EFSF bond.

The bond issue is important in quantity as well: it is designed to raise € 18 bln as part of the € 85 bln rescue for Ireland.

The outside opinion from the Goldman Sachs' Asset Management was such that the Union needed more fiscal measures, as the main problem in the EU was that of governance and structural policies rather than debt crisis.

The issue of fiscal union is becoming appealing for investors: fewer buyers of peripheral eurozone countries' debt make sense of eurozone bond issue and away from individual sovereign issuing.

Avoiding risk in research. Investment in research, development and innovation (RDI) has been identified as a key factor to improve competitiveness and ensure long term economic growth and employment in Europe. But finding private funding sources for RDI projects can be difficult due to their nature:

-

complex products and technologies

-

unproven markets

-

intangible assets

-

information difficult to evaluate by the financial sector.

For this reason, the European Commission and the European Investment Bank have joined forces to set up the Risk Sharing Finance Facility (RSFF). RSFF is an innovative scheme to improve access to debt financing for private companies or public institutions promoting activities in the field of RDI.

RSFF is built on the principle of credit risk sharing between the European Community and the EIB and extends therefore the ability of the Bank to provide loans or guarantees for investment with a higher risk and reward profile. The RSFF has a € 2bn capital cushion, € 1bn from the EIB and the same amount from the Commission's 7 th Research Framework Programme (2007-2013), enabling the Bank to lend more than € 10bn for this kind of investment. By mid-2010 already € 6bln had been committed.

RSFF financing is available for promoters and entities of all sizes and ownerships, including corporations, midcaps, small and medium-sized enterprises, special purpose companies, public-private partnerships and joint ventures, research institutes, universities and science and technology parks (19).

Eugene ETERIS, European Correspondent

References:

1. Special Report on RM // Financial Times. 01.05. 2007.

2. See: Gren S. Managers fail to control hazards // Financial Times, Weekly review of the fund management industry. 06.04. 2009. P. 15.

3. See, e.g. International Marketing: a global perspective, 3rd ed. (Muhhacher H., Leihs H., Dahringer L.) - Thomson Publ., UK. 2006.

4. See: Grene S. Op. cit.

5. See: Financial Times. 27.04. 2009.

6. Financial Times, Editorial, A single stress test. 27.04. 2009.

7. See: Europe's plan threatens private equity // Financial Times. 29.04. 2009.

8. See: Bank of England Report, September 2009.

9. Stern S. The world needs an unbiased global risk assessor // Financial Times. 25.03. 2009. P. 9.

10. See: Munchau W. A recognition of the deep roots of the crisis // Financial Times. 28.09. 2009.

10. See: Financial Times. 04.06. 2010. P. 9.

11. For further information, see:

- EGF website: , and

- European Commission's newsletter on employment, social affairs and equal opportunities. In: .

12. See additional information on the Fund in the EGF's Annual Report: the production of an annual report on the EGF is a requirement of the EGF Regulation (Regulation (EC) No. 1927/2006). The EGF annual report is also a key element in the renewed Social Agenda, as the Fund enables the Union to show its solidarity with those who are made redundant as result of globalization.

13. The Commission's WP for 2010, March 2010 can be seen at:

14. See, e.g. The Economics of European Integration, 3rd ed. (Baldwin R. and Wyplosz Ch.) – McGraw Hill, 2009. P. 550-551.

15. See: Europe must make a plan for reform, not a pact // Financial Times. 03.03. 2011. P. 9.

16. See: Financial Times. 0 4.03. 2011. P. 10.

17. Opinion expressed in: Financial Times. 03.03. 2011. P. 9.

18. See: Financial Times, Markets & Investing section. 18.01. 2011. P. 27.

19.