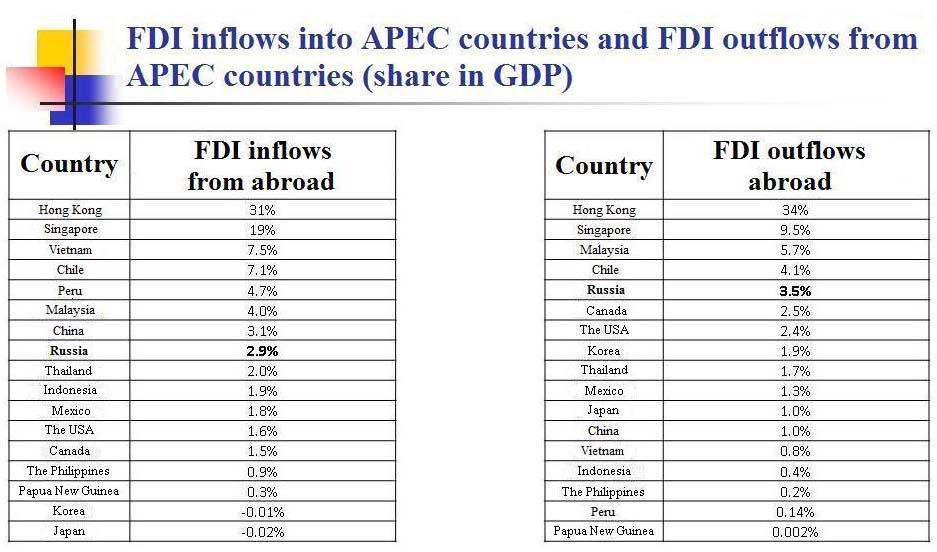

The issue of foreign direct investment (FDI) attraction is very topical in Russia. Our balance of direct investments has been negative recently. However, the outflow of foreign investments abroad is not always bad. It is really bad if we deal with the capital outflow.

The issue of foreign direct investment (FDI) attraction is very topical in Russia. Our balance of direct investments has been negative recently. However, the outflow of foreign investments abroad is not always bad. It is really bad if we deal with the capital outflow.

In Hong Kong, for instance, the balance of foreign direct investments is also negative, but this is not a bad thing, as Hong Kong and Hong Kong residents invest in the acquisition of assets abroad. Many foreign direct investments come to Hong Kong as well.

Russia has very low investment attractiveness for its level of development. They like to compare Russia with the developed countries, but it is not quite correct, as richer countries always have more developed institutions. That is why it is correct to compare Russia with countries of similar levels of development and of similar structures.

Russia is at the worst position on investment attractiveness among countries of similar levels of development in the Asia-Pacific Region. For instance, Russia has the same investment attractiveness as China, but China has a far less level of economic development, and this means, for instance, that China’s labor force is cheaper.

While such countries as Chile, Mexico and Peru with similar levels of GDP per capita have far more investment attractiveness. To this extent as for Russia we have not just competitiveness scissors, but triple competitiveness scissors: our labor force is not cheaper, our level of welfare is not so high, as well as our institutions are not developed very much.

China still has cheap labor force, but its institutions are not yet developed, Chile’s labor force is not yet cheap, but Chile has investment potential which it can implement. Russia has already reached such a threshold as there is no opportunity to move into the category of the highly developed countries with high levels of welfare without developing institutions. There are countries with low levels of economic development, but with well developed institutions; there are rich countries with well developed institution, but there are no rich countries with poorly developed institutions. Thus if we want to move into a new growth strategy, this task needs to be solved as a matter of priority. And this is a so-called investment gap, i.e. a short level of Russia’s investment attractiveness, probably, the most large one among countries and economies in the Asia-Pacific Region.

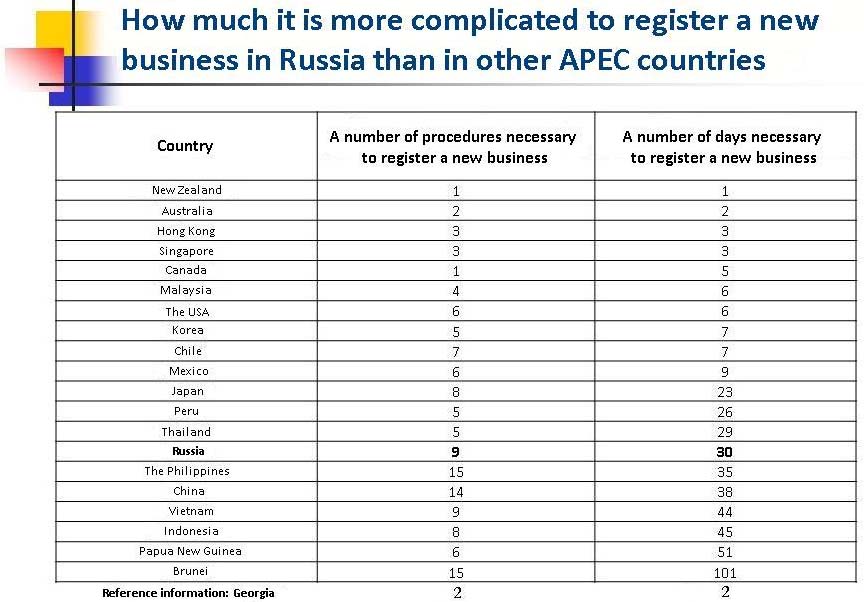

Before speaking about the measures to increase the investment attractiveness, it should be realized what kinds of problems need to be solved. First of all, investors do not perceive Russia as a country where it is easy to start doing business. And the main obstacle is the quality of institutions.

The surveys show that instead of 4% economic growth Russia would have 6% if some institutions worked more efficiently. It would seem that the spread is not too large, but 4% growth gives double GDP over 20 years, and 6% growth gives triple GDP. 3–4% is a growth rate which developed economies can afford. To overtake them and reach the level of developed countries we should have higher growth rates, therefore, having 4%growth Russia will not solve its strategic tasks.

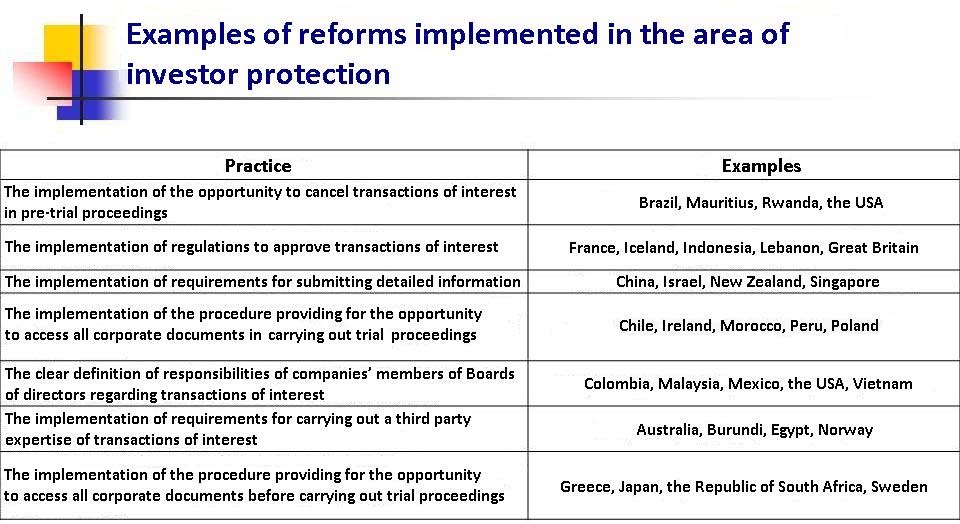

The institutions may be divided into two parts. The fundamental ones — they cover most part of the economy and cannot be changed very fast. Such institutions include all the anti-corruption methods, the property rights protection, and the investment attractiveness on the whole. However, some rules may be changed fast enough if there is a political will. In particular, this is trade liberalization, freedom of the mass media, permission for foreign investors’ access to the spheres closed for them earlier, legislative changes in the sphere of property and tax payments.

Among the reforms which ease doing business are simplification of the procedures for the establishment of companies, obtaining construction permits, connection to electrical supply networks, property registration, attraction of credits, tax payments, securing execution of treaties, settlement of financial insolvency; simplification of the rules and procedures for international trade; protection of investors.

The implementation of strategic goals to move Russia from the 120th place to the 20th place in the ranking on the ease of doing business can be reached in the frame of legislative changes at most. And then it will redound to improvements of the whole institutional climate.

Reforming the system for protection of investors’ rights should be implemented on the basis of “the best practices” in the Asia-Pacific Region.

The welfare has increased in Russia during recent decades, but the quality of institutions either fell as the Investment Attractiveness Index shows or stagnated as the Cumulative Economic Freedom Index shows. The only index which shows that Russia grew more or less is the International Trade Freedom Index. This is a direction in the frame of which further development is possible.

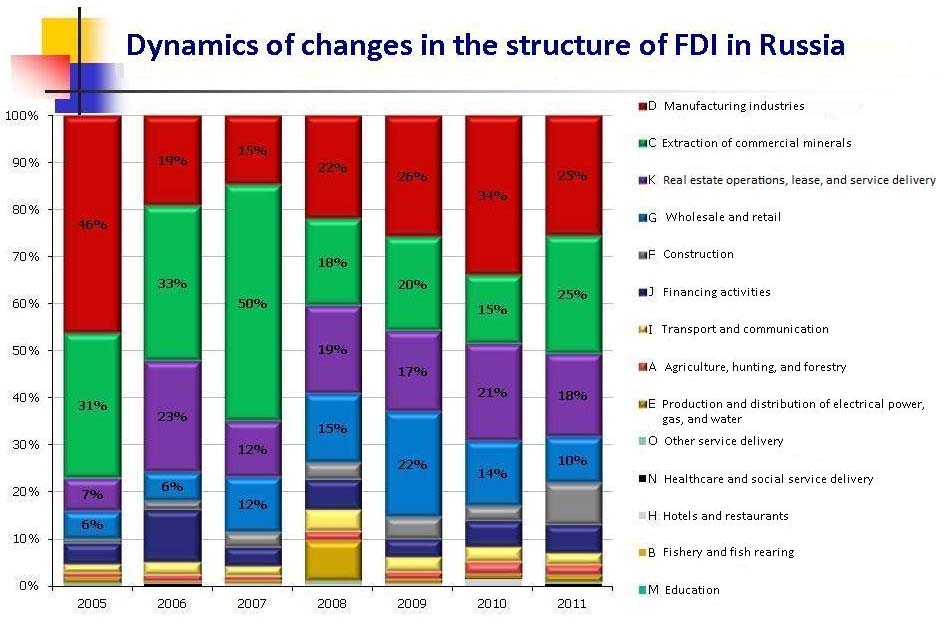

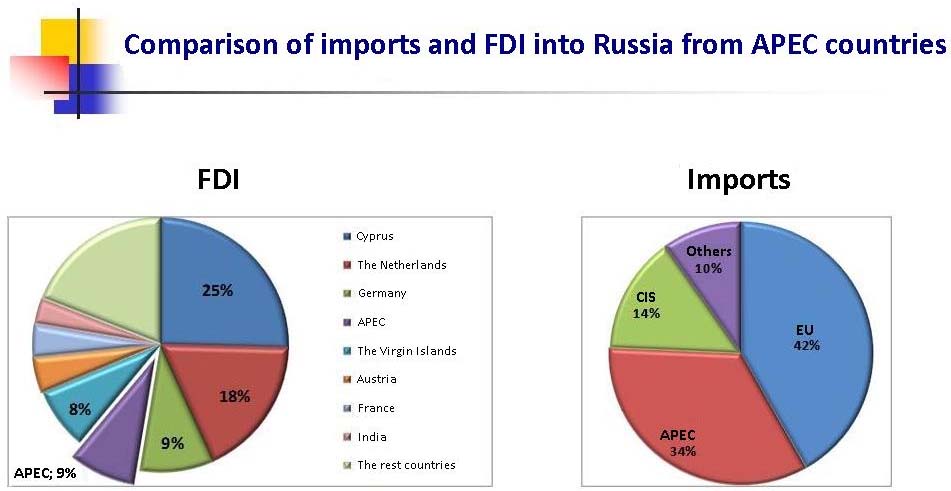

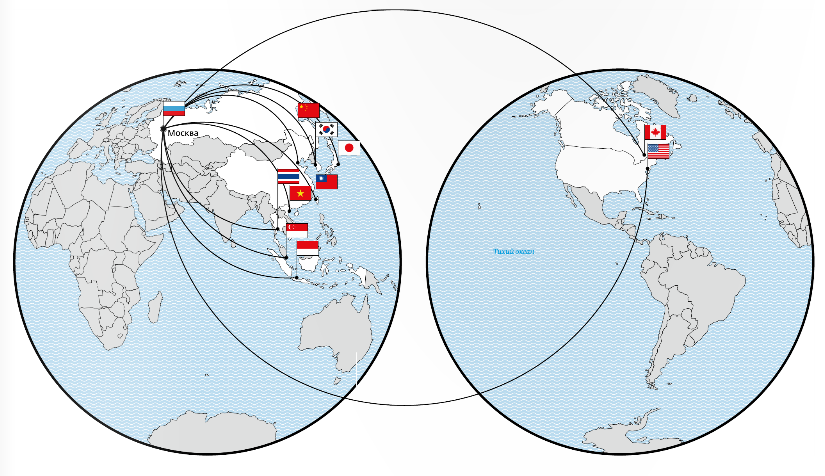

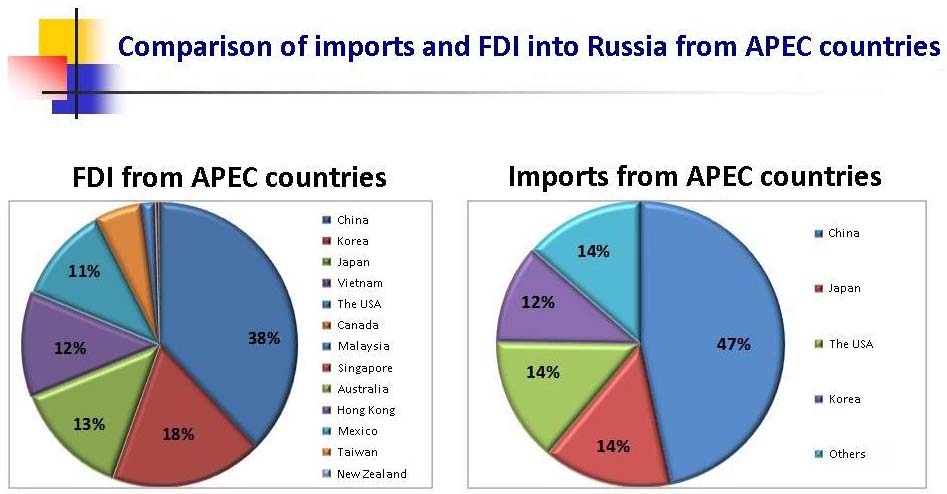

The structure of foreign direct investments is not stable and ideal in Russia. We would like more investments to be directed to the manufacturing sector. If we compare the structure of trade with the structure of foreign direct investments, it shows that Russia buys significant volume of goods in the APEC economies, but poor investments come to our country from the Asia-Pacific Region, i.e. we are much more attractive for the APEC countries as a distribution area than as an investment object. If we compare such indices as the procedures which are necessary for the registration of a business and a number of days which are necessary for the registration of a new business, we will prove to be far from the forefront of leaders, with our major “competitors” being countries of similar levels of development, i.e. these are Malaysia, Chile, Mexico, Peru. While having similar levels of wages and welfare, they can offer businesses much better terms and conditions.

The practical task of changing a country’s place in some ranking may be solved without taking care of real improvements in the state of affairs. The ranking on the ease of doing business is compiled on the basis of actually passed legislative changes. A plain list of these legislative changes may let rise up through several tens of places in this ranking, with it taking only a year. However, the task that faces our country is still different. It is more global, i.e. it is to improve the investment attractiveness and business climate (the source: Information Department of the Russian Research Center for APEC, the speech and presentation by A.U. Knobel during the roundtable discussion “Investment climate in Russia and APEC: problems and prospects”, 19.04.2012).

* Originally published in “Investments. Facts and comments.” Issue 26.